One of my PhD thesis advisors, Sinclair Davidson, wrote a great piece on the subject here. I write to further expand on his comments. The key quote from Sinclair’s piece is as follows:

Trump should have labelled his tax grab as a reciprocal consumption tax and not a tariff.

This is exactly what Trump’s tariffs actually are. They are consumption taxes.

So one may ask, why is a Republican raising taxes in the first place? Aren’t they the party of cutting government spending?

Here’s the political reality of American taxation. The US has no federal level consumption or sales tax. This means the US federal government is atypically dependent upon income taxes, which in turn means federal revenues are quite volatile because income tax revenues fluctuate with the business cycle. In order to address this problem, many Republicans have advocated tax reforms that “broaden the base” - i.e. consumption taxes.

But according to the Democratic Party, consumption taxes are morally evil. This is because consumption taxes are regressive - they impact the poor more than the rich because the poor spend a higher portion of their income on consumption. Despite the fact that the Continental European Social Democracies so beloved by the Democrats are mostly funded by such consumption taxes, the Democrats believe the only morally acceptable tax policy is “Tax The Rich,” which is just a code-phrase for punitive and resentment-based income taxation on anyone who earns more than Elizabeth Warren.

But Taxing The Rich runs into the problem of the Laffer Curve - governments can see reduced tax revenue from increased tax rates. There are documented instances where governments have increased their revenues from cutting taxes - George W Bush’s tax cuts, for example, did precisely this. This didn’t stop Obama from letting those tax cuts expire though, because the Democrats’ taxation policy is driven more by resentment than it is by a desire to raise revenue - the Donkey Party sees Taxing The Rich as a matter of morality and an end in itself rather than as a means to other ends.

We must also factor in the fact that Trump’s base is solidly working class - in other words, his own voters will feel the impact of a consumption tax most acutely.

So, put yourself in Trump’s position. DOGE is almost certainly going to underdeliver (despite the necessity of it). You’re already in the upper portion of the Laffer Curve so you can’t get more money by raising income taxes. Cutting Social Security and Medicare benefits is absolutely off the table despite these programs being terribly designed and mathematically unsustainable in an aging society. And if you were to levy a consumption tax or national sales tax, you’d be (not unjustifiably) accused of taxing the poor and betraying your own voters.

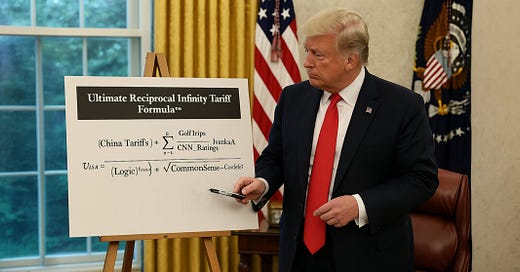

So what politically acceptable option do you have? The answer is the “reciprocal tariff” (or reciprocal consumption tax). This simultaneously allows you to avoid calling it a consumption tax whilst also allowing you to blame other governments for it (i.e. “its reciprocal - they charge a 10% tax on every American product sold in their country!”).

I don’t like it either, but let’s not pretend that the Danger Yam is the sole bearer of responsibility here. Like all politicians, he acts within a political culture that has certain incentives built into it. This political culture comes from many sources - from the American Civil Religion (the Revolutionary inheritance), from the Constitution, and also from both partisan establishments. And the Democratic Party has, successfully, managed to make federal consumption taxes politically radioactive. Indeed, the Democratic Party’s approach to taxation is driven by nearly religious impulses: as the Obama Administration proved, they’re happy to charge above the revenue-maximizing income tax rate simply to take from the rich, despite the fact that in doing so they end up with less money overall to give to the poor. The expropriation is the end, not a means.

So, without being able to broaden the base by levying a consumption tax, with improvements to government efficiency having their limits, and with Laffer Curve effects making increased income taxation impractical as a revenue-raising mechanism, what is a government-on-the-brink-of-fiscal-collapse to do?

We now know the answer. Call a consumption tax a tariff and blame other countries for it.